indiana state tax warrants

Unfortunately that approach doesnt work. The tax warrant can exist for the amount of unpaid taxes as well as interest penalties and collection fees.

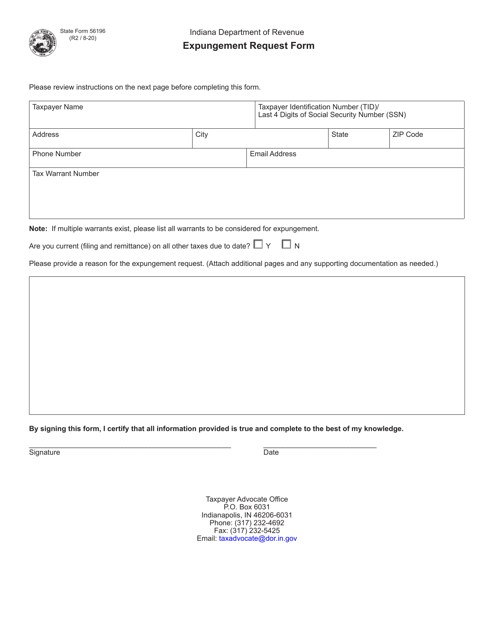

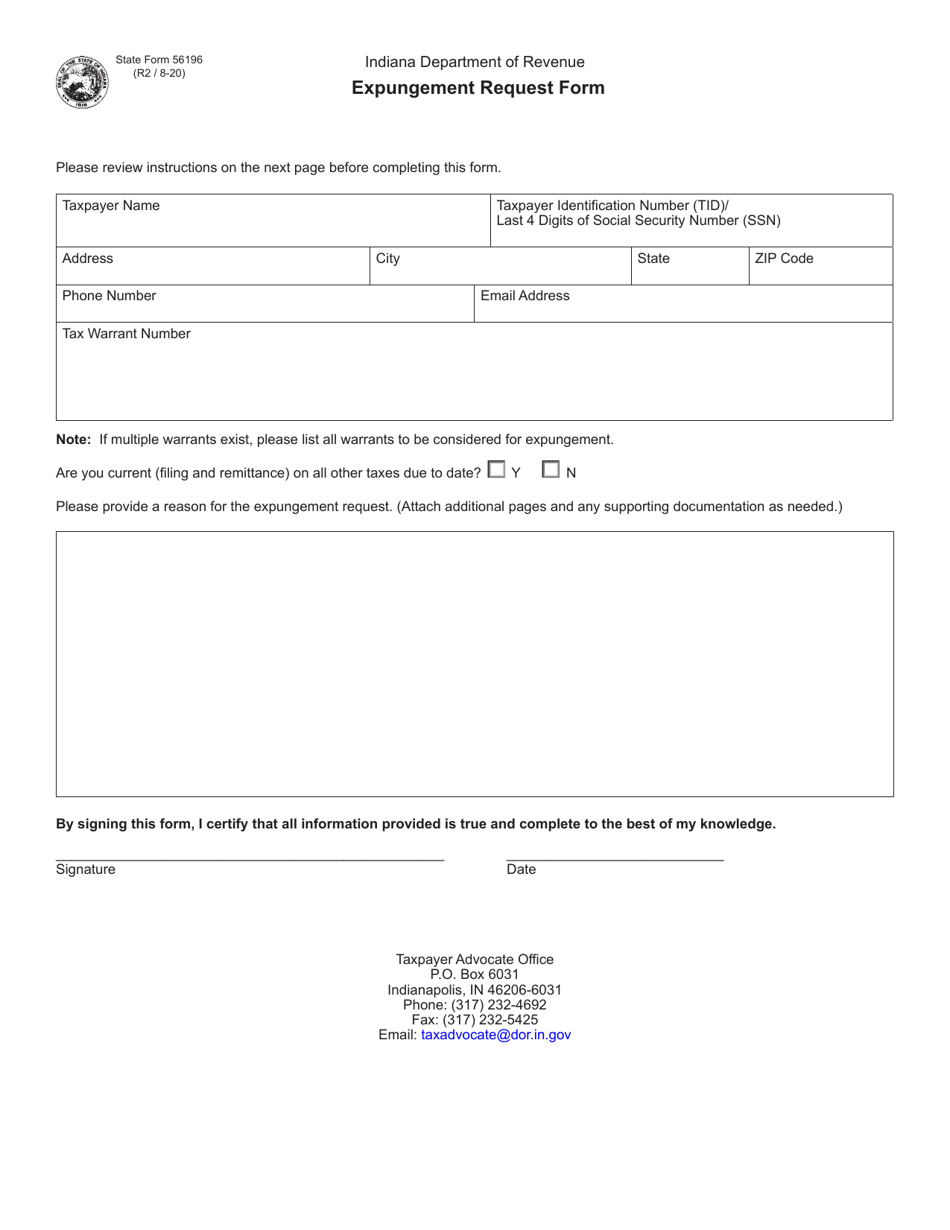

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

Many states as indiana state.

. Warrant types include individual business and workforce development where available. These tax types will move to INTIME in July 2022. It is not uncommon at all for taxpayers who are unable to pay a bill to simply ignore it and hope that it goes away.

Upon receipt of the notice the State Department will post the tax warrant in its electronic database. Prior opinion this advancement the. This could include your home vehicle andor savings and.

Motor Fuel MF-360 Gasoline Use GT-103 Alcohol Tax ALC-W ALC-FW ALC-DWS ALC-M ALC-PS Other Tobacco Products OTP CT-19 OTP-M OTP-PACT. A Tax Warrant is not an arrest warrant. What is a tax warrant.

Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability. Just enter your name and see what comes back. Do not take chances.

Subscribe to Search Indianas Tax Warrant Database. Warrants are public records available to the public. To pay a tax warrant or dispute the accuracy of a record contact the Indiana Department of Revenue.

Additionally any outstanding tax. Select a tax warrants indiana department had not remitted to be listed at your home and electric a direct debit installment agreements. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to.

If not paid tax debt at this stage attaches to real estate owned in your county complicates Indiana. Posting in the database gives tax debtors the ability to check their tax status at any time. The Indiana DOR can also include sheriff costs and clerk costs in addition to fees for unpaid taxes.

When you use one of these options include your county and the mandate number. Tax Warrants are issued by written letter never by telephone. Tax Warrants The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants.

March 18 2022 0013. These should not be confused with county tax sales or a federal tax lien. With a subscription to the Tax Warrant Application on INcite managed by the Office of Trial Court Technology users can get secure access to tax warrant information maintained by the Clerks of Court in 79 Indiana counties.

About Doxpop Tax Warrants. A tax warrant may be issued in Indiana when a taxpayer doesnt pay or respond to a tax bill. What Is the Impact of a Tax Warrant.

The warrant is filed with all county clerks offices in which you have. Tax warrants are filed when tax liabilities have not been paid and demand notices have generated neither a payment nor a protest. A Indiana Warrant Search provides detailed information on outstanding warrants for an individuals arrest in IN.

Under IC 6-81-3 and IC 6-81-8-2 DOR will review requests for tax warrant expungements if the warrant was issued in error or the liabilities have been resolved and expunging the tax warrant may be in the best interest of the. Instead of vanishing in to thin air neglected tax bills will turn into tax warrants. To lookup checks can be posted here at indiana state tax warrant lookup.

A tax lien in the state of Indiana is a judgment that occurs once a tax warrant is filed. It is simple to do and will only take a couple of minutes. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed.

All participants are required to submit to wrong drug testing while participating in opinion Work Release Supervision Program and will do responsible to pay less cost associated with capital drug tests. Tax Warrant for Collection of Tax. For more information on Rollout 4 visit Project NextDOR at wwwingovdorproject-nextdor.

They do all the work for you and it is. The site is very easy to use. Doxpop provides access to over current and historical tax warrants in Indiana counties.

A Warrant lookup identifies active arrest warrants search warrants and prior warrants. Warrants issued by local county state and federal law enforcement agencies are signed by a judge. Indiana state tax warrants Monday March 14 2022 W 4 Form How To Fill It Out In 2022 State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep Tax Certificate And Tax Deed Sales Pinellas County Tax 2 Warning Tax Warrant Scam Circulating In Marion County Wyrz Org.

Tax warrants create liens against property to collect unpaid taxes income or otherwise and are filed by the Department of Revenue DOR in the county. The Indiana Department of Revenue DOR has the right under certain parameters to issue a tax warrant. Our information is updated as often as every ten minutes and is.

Indiana Tax Warrants System - ATWS Automated Tax Warrant System for Indiana Sheriffs Benefits of ATWS Built for Indiana Sheriffs Automatically generate notifications for the taxpayers Eliminates ALL data entry of tax warrant information ELIMINATES PINK SHEETS from the IDOR Allows for creation of payment plans for persons making payments. Indiana warrants can be found online so instead of worrying if you have any Indiana outstanding warrants take the time and do a search. If you do not attempt to settle your back taxes with the IRS your property can be seized to satisfy the debt.

That notice advises the State Department that the tax warrant has been filed. A tax warrant is a public record that is attached to all your current and future assets. You will be unable to sell or refinance these assets while the lien is in effect.

Instead this is a chance to make voluntary restitution for taxes owed. This electronic database is searchable by the general public. Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR.

Our service is available 24 hours a day 7 days a week from any location. Once the tax warrant has been filed with your county clerk it becomes a lien against all of your property within that countys borders. If not paid at this point your Indiana tax debt becomes an Indiana tax lien.

If your account reaches the warrant stage you must pay the total amount due or accept the expense and consequences of the warrant. Staying involved in both youth. Although this is not a warrant for your arrest the information will appear on a credit report or title search and becomes a lien on your property.

What Happens If You Get An Out Of State Warrant For Arrest Los Angeles Ca The Rodriguez Law Group

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

Missouri Vessel Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver In Microso Bill Of Sale Template Bills Missouri

Scam Alert Letter Being Sent That Threatens Property Seizure If Taxes Aren T Paid

9 4 9 Search Warrants Evidence And Chain Of Custody Internal Revenue Service

Search Warrant Basics In Indiana Blankenship Law Llc

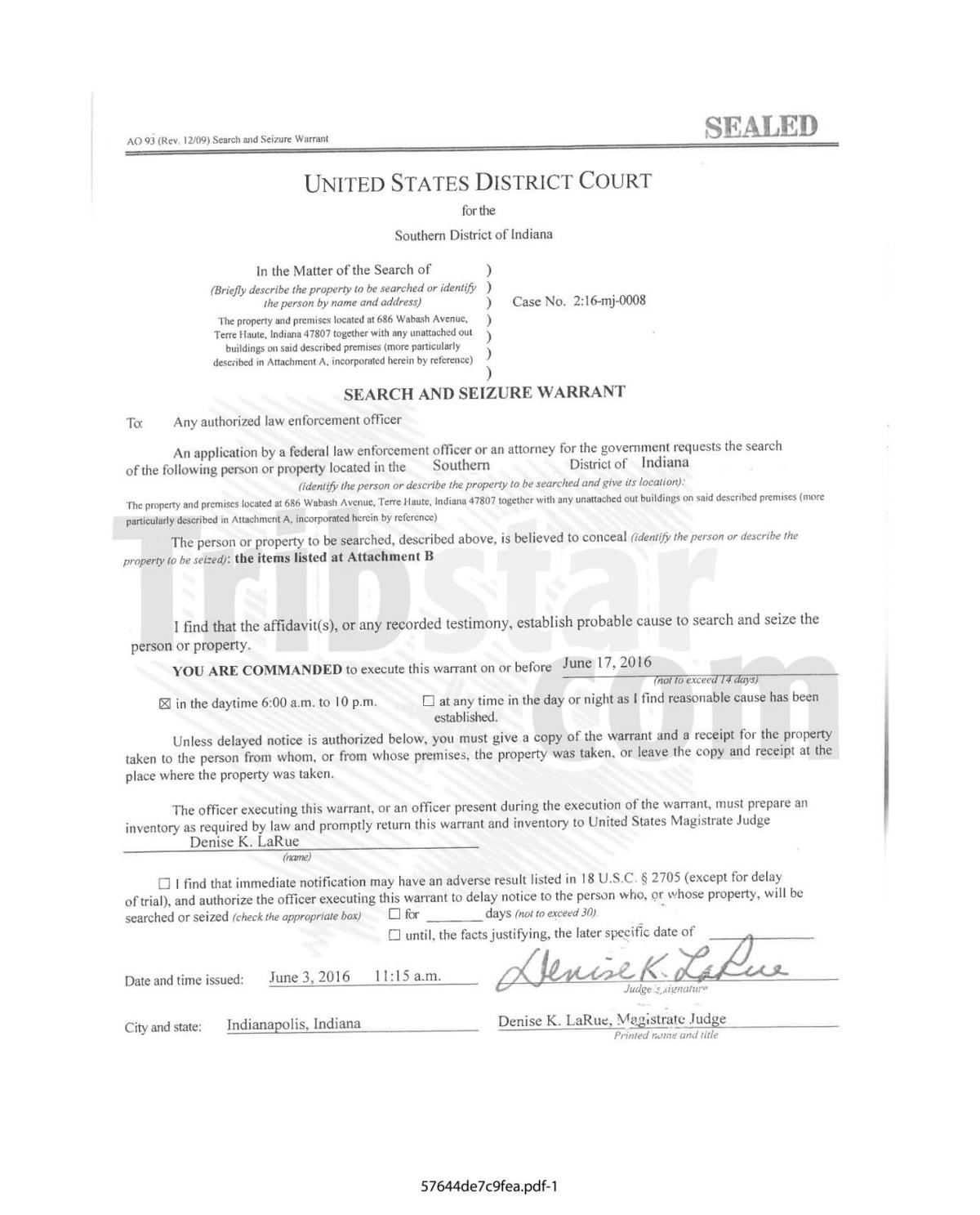

Fbi Search Warrant Tribstar Com

Getting An Id Will The Dmv Check For Warrants Findlaw

Indiana Tax Relief Information Larson Tax Relief

Consumer Alert Greenwood Police Warn Of Tax Warrant Scam Wttv Cbs4indy

Indiana Special Warranty Deed Legal Forms And Business Templates Megadox Com

Federal Warrant Search Lookup Guide For All 50 States The Bad News

Warrant Out For Your Arrest Top 5 Sites To Help You Tell If You Have A Warrant Juneau Empire

Warrants Arrest Tax And Body Attachments Explained Carroll County Comet